Closing an HDFC bank account can be straightforward if you follow the proper steps. HDFC provides an account closure facility to customers who may want to switch banks or don’t need multiple accounts. This comprehensive guide will cover all the details you need to close your HDFC account smoothly. HDFC Bank is one of the premier private banks in India. It offers a wide range of financial products like savings accounts, current accounts, loan products, credit cards, and more. As per RBI guidelines, HDFC customers must maintain a certain average monthly balance in their budgets to avoid penalty charges. The minimum balance is Rs 5,000 for metro city accounts and Rs 3,000 for rural accounts. Maintaining multiple bank accounts can make keeping the required minimum balance in all accounts challenging. Closing unused or idle HDFC accounts can help reduce this hassle. You should shut your HDFC account if you are shifting to another bank or no longer need that account. The process to close an HDFC account permanently is straightforward if you follow the step-by-step procedure outlined below.

So it is best to close the account within two weeks or after one year of opening to avoid closure fees. Customers wanting to port to another bank can open a new account first and then shut their HDFC account after 12 months when there are no charges.

Follow these key steps to close your HDFC bank savings smoothly, current or another account:

Withdraw or transfer out the entire balance amount from your HDFC account before beginning the closure process. You can transfer funds via NEFT, RTGS, IMPS, or UPI to move the money into another active bank account you hold. Ensure you have drained the full balance and the account shows zero balance.

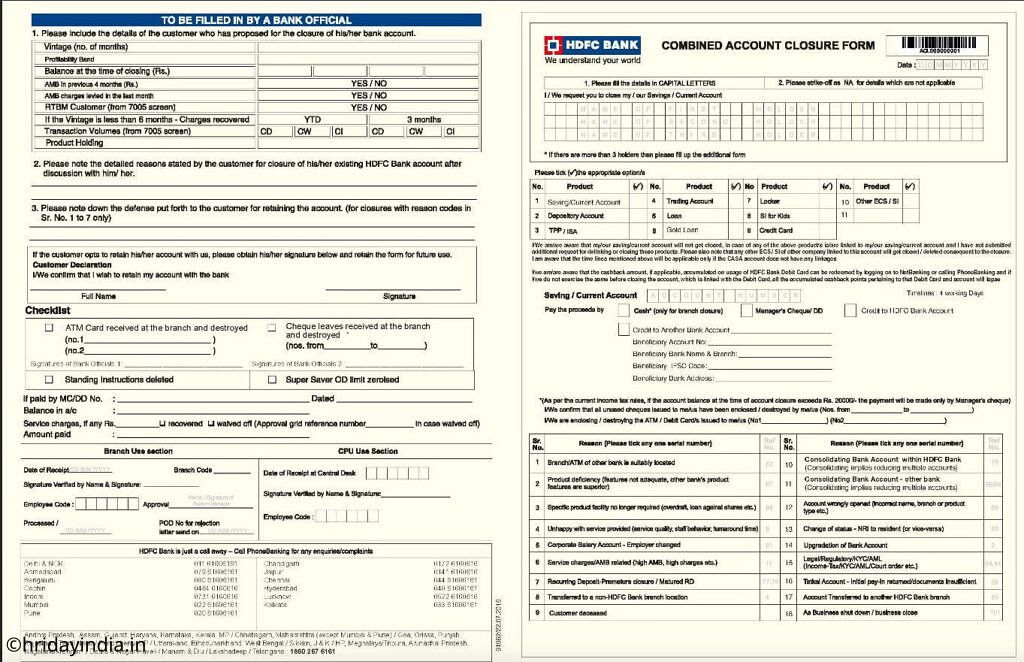

You can download the HDFC account closure form from the official website. Alternatively, visit the nearest HDFC branch and get the account closure form. The form will require you to fill in personal details like name, account number, reason for closure, etc.

Carefully provide all information sought in the account closure form. Fill in personal details like name, contact information, and account number accurately. Check there are no errors before submission.

Visit your nearest HDFC bank branch with the duly filled account closure form. You must submit photocopies of KYC documents like Aadhaar, PAN card, and voter ID as proof. Carry original KYC documents as well for verification if needed.

When submitting the account closure form, you must hand over the account chequebook, debit card, and passbook to the branch representative. This completes the bank’s records related to your account.

The HDFC branch executive will verify all documents and issue an acknowledgment receipt for your account closure request.

HDFC will process the request and close the account within approximately ten working days after submission of the form. The account will get permanently closed within this duration.

Here are some essential things you must do before submitting the account closure request:

These steps will ensure a smooth transition when closing your HDFC bank account.

Here are some common queries answered on closing an HDFC bank account:

Currently, HDFC does not offer the option to close an account digitally or online. You must submit the account closure form at an HDFC bank branch.

If you close the HDFC account after 15 days but before completing one year, closure fees of Rs 500 (Rs 300 for senior citizens) apply.

Clear the negative balance first by transferring funds into the account. Once the account has zero balance, submit the closure request at the branch.

No, closing savings and current accounts require visiting the HDFC bank branch. There is no online closure facility yet.

No, you cannot reopen a closed HDFC account. You must open a new report by submitting the account opening form online or at a branch.

HDFC closes accounts within approximately ten working days after submission of a physical request at the branch.

You must submit the account closure form, photocopies of KYC documents like Aadhaar, PAN, Voter ID, and originals for verification. Also, submit the account checkbook, debit card, and passbook.

You can contact HDFC customer care at 1800-227-227 or the branch manager if you face any issues while closing your account. Executives will assist you.

We hope this detailed guide covering the entire process, documents, charges, and other aspects helps you close your HDFC bank account quickly. Remember to transfer funds, download the form, fill in details accurately, visit the nearest branch, submit documents, and collect the receipt. If you face any issues, don’t hesitate to contact HDFC customer care for a quick resolution.